When it comes to income verification processes, PDF Data extraction used to be a battle between an employee and their computer's copy/paste functions. But now that humans can automate this data extraction process from documents using AI technology, employees experience higher job satisfaction, capture more insightful data to analyse and create happier applicants.

Intro

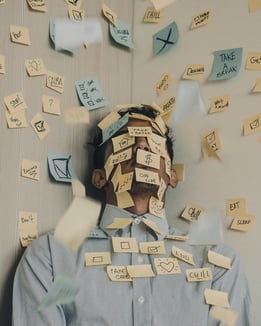

Every industry is tackling the same pressures: increasing revenue, reducing costs, and satisfying high customer demands. But the reality is, no matter how many more people an organisation onboards, these pressures are often challenging to achieve – leading to employee burnout and unsatisfied consumers.

Now let's turn to the topic of income verification.

Switzerland has a "Bundesgesetz über den Konsumkredit" (Federal Law on Consumer Credit) which means that lenders have to ensure that the amount borrowed is bearable to one's net income. Consequently, this means that those who handle verifying clients' income must collect more documentation from applications and analyse them more extensively.

Companies are ultimately turning to automated data extraction software to simplify these manual processes.

What is Automated Data Extraction?

It is software that automates the process of transforming unstructured/semi-structured data into structured data. In other words, it means to extract data from documents and process them into the desired format that humans can quickly analyse. Automated data extraction software can ultimately extract data from sources like emails, PDFs, scanned documents, etc.

Ways that Automated Data Extraction Improves Income Verification

- Cost Saving

- Reduce data errors

- Increase efficiency

- Helps your team

- Reveals more value from the data

- Fraud detection

Check out how a major Swiss bank enhanced the efficiency of its payroll processes with Acodis IDP.

Cost Saving

If we briefly return to the introduction of this article, we see that reducing costs is a pressure faced by most organisations. Therefore, automated data extraction software is becoming increasingly popular for those who manage income verification processes.

But how does it save the organisation money?

Managers have enormous amounts of pressure to hire more people to deal with these long-winded processes. Suppose we use a bank as an example - verification officers will cost the bank a lot of money in the long run from their steep salaries – but with automation software, there would be less pressure for managers to hire more professionals to manage these tasks.

Reduce Data Errors

Income verification steps throughout loan applications need to be 100% accurate. There can’t be any wiggle-room for marginal errors.

If an organisation incorrectly processes a client’s income as CHF150,000 per year instead of CHF50,000, the consequences could devastate the lender’s reputation as well as harm the client’s ability to repay a loan that shouldn’t have been authorised.

Increase Efficiency

We live in a digital age – being able to apply for credit via your mobile phone is not that impressive anymore – but consumers are increasingly expecting faster and faster decisions. As indicated by the Swiss Federal Law on Consumer Credit in the introduction, the credit process has continued to become stricter and demands more documentation. So how can we balance these new consumer expectations and the prolonged process?

Automated data extraction continuously learns about how an organisation's documentation looks as it continues to improve its output's quickness and accuracy. Unlike humans, this type of software doesn't get tired and can work around the clock – which is perfect for satisfying consumer demands.

Above all, the majority of income verification processes involve someone handling PDF documents, which are not always easy nor quick to extract information from. When you extract data from PDF using an automated system, it can save time significantly across not only your team but your entire company.

Helps Your Team

While data extraction software can't directly help you from overhiring, it can certainly help your current team. It's not rocket science that typing in data is a boring task, but thanks to PDF data extraction software, team members have less time spent on these duties which ultimately can lead to higher employee satisfaction.

And while a lot of essential tasks such as income verification require the 4-eye principle (where someone types in data, then someone else double-checks), automating this process means that your team will stumble across fewer errors throughout this step.

Reveals More Value From The Data

Income verification entails a heavy number of documents that are full of numbers, phrases, etc. A trained professional is, of course, able to identify the data points needed to carry out a proper income verification – but can often miss, or skip, the finer details of a client’s income.

For example, an automated data extraction software would be able to identify secondary income streams (e.g. child allowance), enhancing the client’s application. This would ultimately help the lender create a more cohesive, considerate decision.

Fraud Detection

Data extraction systems can be set in place to mitigate the risk of fraudulent activity, e.g. if someone has manipulated a number, date, etc. In full, this can help banks potentially save a lot of money in addition to easing the minds of the team members who directly deal with these applications.